With an increasing number of people looking forward to travel after being locked down for so long, the awareness of the importance of travel insurance has been rising with that desire. In fact, a survey reported by LinkedIn at the beginning of the year revealed that 90 percent of respondents planned to travel in 2021 and more than half said this time they’d be more likely to buy travel insurance for their trips.

Many learned the hard way by losing significant amounts of money during the COVID-19 pandemic that most travel insurance policies didn’t provide coverage for a situation like the coronavirus unless it was a cancel-for-any-reason policy. That was the only type that offered at least some coverage until recently with more insurers introducing policies to address cancellations and interruptions.

With some types of insurance, it’s a no-brainer. Moving into one of the Washington DC apartments? You need renter’s insurance. Buying a new car? You probably can’t drive it off the lot without insurance coverage. But when is it a good idea to purchase travel insurance? After all, it’s not required. Of course, if you’re spending thousands of dollars on airfare, accommodation, and other expenses, that’s a big financial commitment. It makes sense to buy travel insurance as it can help offset losses when the unexpected happens.

There are many scenarios that can occur where having travel insurance will definitely pay off, including these.

Weather

It’s not just a pandemic that can cancel flights. Remember the volcanic eruption in Iceland that spewed so much ash that thousands of passengers had their flights cancelled in 2011? And then there are the frequently increasing tropical storms and hurricanes, tornadoes, and even wildfires to consider too. If you have travel insurance and weather gets in the way it will cover delays and cancelations. Should a flight be canceled while you’re at an airport, you’ll be able to book a hotel through your insurance rather than spending your days and nights waiting near the gate.

Medical Emergencies

Many medical insurance policies don’t cover costs incurred outside of the country which makes travel insurance a must when traveling internationally. If an accident happens and you don’t have it, you could find yourself in a situation where you need to pay tens of thousands or dollars for services without being able to fly back home quickly. Some countries now require proof of insurance that covers medical costs in order to enter, including coverage for ambulance services, tests, doctors, and other related expenses.

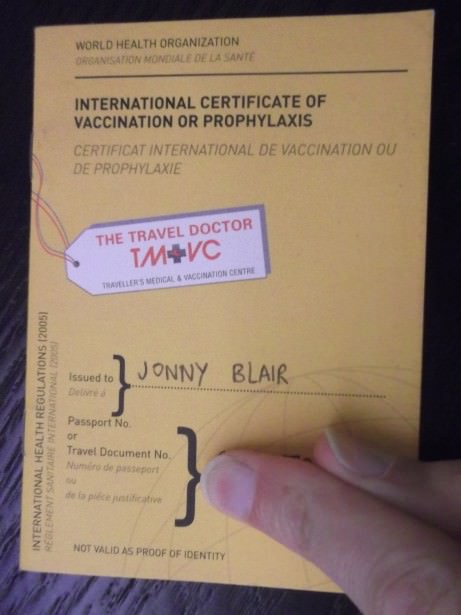

My Yellow Fever Certificate – also known as International Certificate of Vaccination or Prophylaxis Against Yellow Fever

Becoming Ill or Injured Before Traveling or During Your Trip

If you develop an illness or become injured just before you’re expected to depart, travel insurance can cover the cost to cancel or re-book. Should something serious happen during your trip and you need to end it early to get home as soon as possible, your travel insurance can help with that too.

Lost or Stolen Items

If your luggage is lost, damaged, or stolen during your trip, a travel insurance policy that includes luggage coverage will reimburse you. Some also cover delays so that you can pay for items you need to buy while waiting for your luggage, like toiletries and clothing. If you lose your passport or it gets stolen, it can be a huge headache in a foreign country but as long as you have travel insurance, your insurer will at least reimburse the loss and related expenses.