As a long term traveller and liveaway Northern Irishman, I am fully aware of the problems we face with money, taxes, visas and trying to keep within the laws as we venture around the world. In my life I have paid taxes in Northern Ireland, England, Poland, Hong Kong and Australia. As a novice, I often needed friends to help me understand tax laws and tax systems. I spent so long trying to work it out. So for a United Kingdom citizen, it can be tricky but imagine for US citizens – life gets even harder.

Americans (USA) living outside of the United States must file US taxes on all their worldwide income. When you are in lands afar, this is particularly hard, especially in countries like Russia and China where language can be a major issue. There are some online tax guides on travel and business sites worth checking out and they can help you in this regard.

Moving on from that, there is even a specific website geared towards helping you and it is called Taxes for Expats. Now personally I prefer the term immigrant and I never class myself as an expat, expatriot or expatriate, as it sounds like they used to be patriotic and are no longer. I’m an immigrant. This is where Taxes for Expats comes in to really help you out, keeping you within the law while still working overseas.

With the Taxes for Expats (TFX) system, there are easy to follow steps and expert guides to ensure your taxes are paid correctly, on time and within the United States law. You can see the product pillars of TFX which include:

1.Expert human help

You’re not talking to machines. You are talking to experts here. These experts deal with taxes every day and know the US system inside out, to ensure your job of paying taxes when overseas is made much easier and smoother.

2.Fair upfront pricing

The fees for the service are all paid up front, in honesty and with no catches at all. There are no hidden payments or snags.

3.Superb system

Just visiting the TFX website is an easy way to see how superb a system this is.

4.Top rated firm in the niche of expat taxes

It’s always good to know that the company you are working with has a good reputation. TFX are well known in the industry and have been specialising in organising tax issues for years. Your tax situation is in good hands.

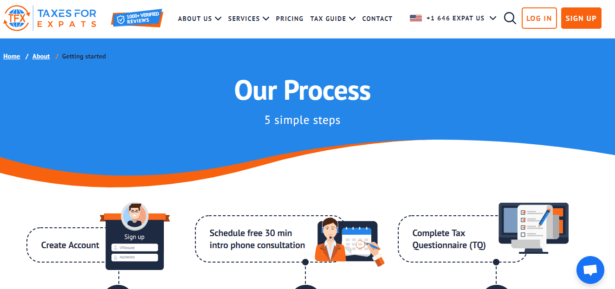

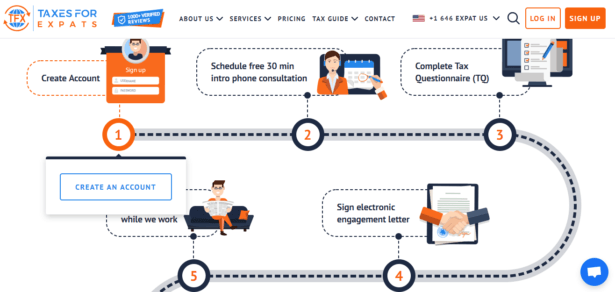

So once you have visited the website TFX, you will see how easy it is to use their service and let them help you on your journeys and adventures outside the USA. You will find an easy to fill out tax questionnaire as well as a My Documents section. The process is simple and easy to understand. Here is how the TFX process works:

Step 1 – Create your account

It’s easy – you sign up, add all your personal details (which are kept private of course) and get your username and login.

Step 2 – Schedule your 30 minute telephone consultation

Once you have created your account, the next step is to speak to one of the experts at Taxes for Expats. It will be a 30 minute telephone conversation to guide your through the process. This is free of charge, and you won’t need to pay for anything until you confirm to use the service.

Step 3 – Complete tax questionnaire

Then it’s time for tax information as you fill in all your tax details on the tax questionnaire.

Step 4 – Sign electronic engagement letter

Then once you are happy you can sign the electronic engagement letter and are ready to go. This is the formal contract that allows Taxes for Expats ensure your tax is being paid within the US regulations.

Step 5 – Sit back and relax

Then you sit back and let Taxes for Expats do all the hard work for you. It’s that simple!

Overall, Taxes for Expats is a perfect solution for US citizens living abroad. This is particularly helpful for those living abroad who are too busy or unaware of how to go about organising their tax while overseas. It will certainly allow you more time and freedom to work, rest and play while Taxes for Expats do your work for you!